登錄網上銀行

個人銀行

商業銀行

登錄網上銀行

個人銀行

商業銀行

登錄網上銀行

商業銀行

查詢最新匯率,請致電 626-279-3235 聯繫外匯部。

April 21, 2025

The Federal Reserve can make more reductions as projected earlier but policymakers should wait for more clarity regarding trade and other policies, said Mary Daly, President of the Federal Reserve Bank of San Francisco. U.S. inflation is moving closer to the 2% goal, but "we aren't there yet", Daly mentioned in a LinkedIn post. She pointed out that the inflation risks are elevated compared to a year ago and that the Fed is in a good place with policy and there is time to make a good decision.

Monetary policy is still restrictive and there is room to make gradual reductions in the fed funds rate as projected earlier, she added. The Fed's next monetary policy meeting is scheduled for May 6-7 and the central bank is widely expected to maintain the status quo. 04/18/2025 - 16:02:00 (RTTNews)

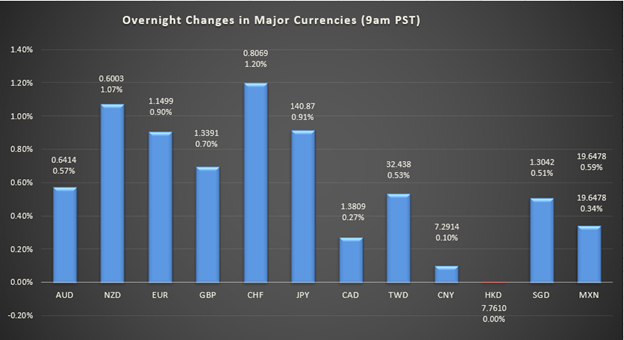

Japanese Yen traded at 140.87 against USD at 9:00 AM PST.

Overall consumer prices in Japan were up 3.6% on year in March, according to the Ministry of Internal Affairs and Communications. That was in line with expectations and was down from 3.7% in February. Monthly, inflation rose 0.3% after slipping 0.4% the previous month. Core CPI was up 3.2% on the year, matching forecasts and up from 3.0% a month earlier. 04/17/2025 - 19:38:00 (RTTNews)

國泰銀行準備的此市場最新訊息僅供參考,不構成任何形式的法律、稅務或投資建議,也不應被視為對未來匯率變動或趨勢的保證或擔保。提供此信息時沒有考慮任何接收者的特定目標、財務狀況或需求。國泰銀行對本市場最新訊息的準確性、完整性或充分性不做任何表述或保證。